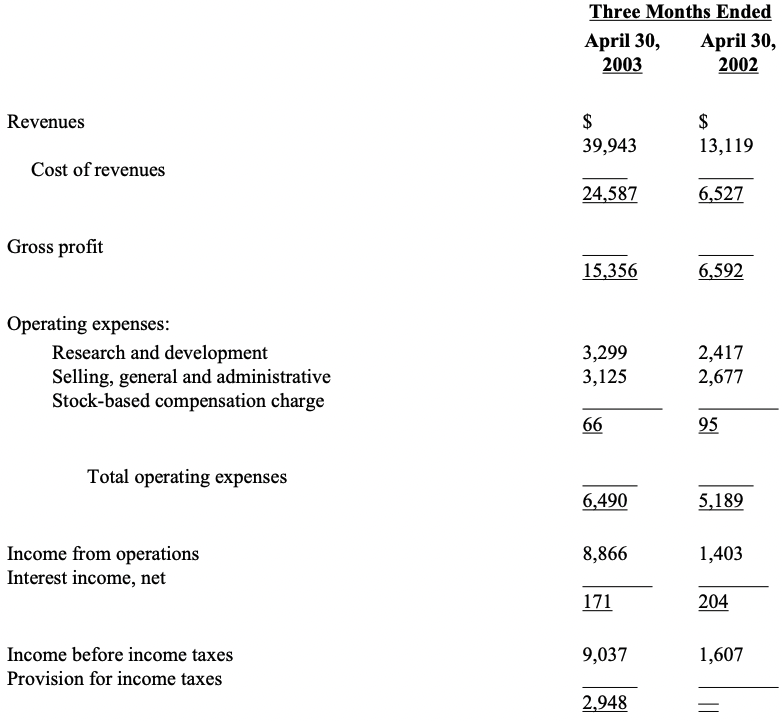

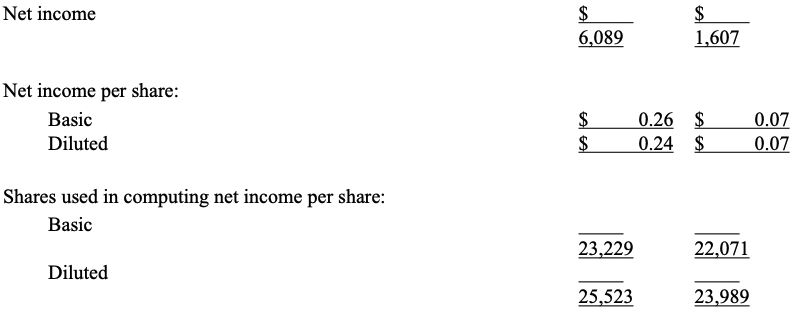

SUNNYVALE, Calif. – June 11, 2003 – OmniVision Technologies, Inc. (Nasdaq: OVTI) reported that in the fourth quarter of its fiscal year ended April 30, 2003, it earned $6.1 million, or $0.24 per diluted share, on revenues of $39.9 million, compared to net income of $1.6 million, or $0.07 per diluted share, on revenues of $13.1 million in the fourth quarter of fiscal 2002.

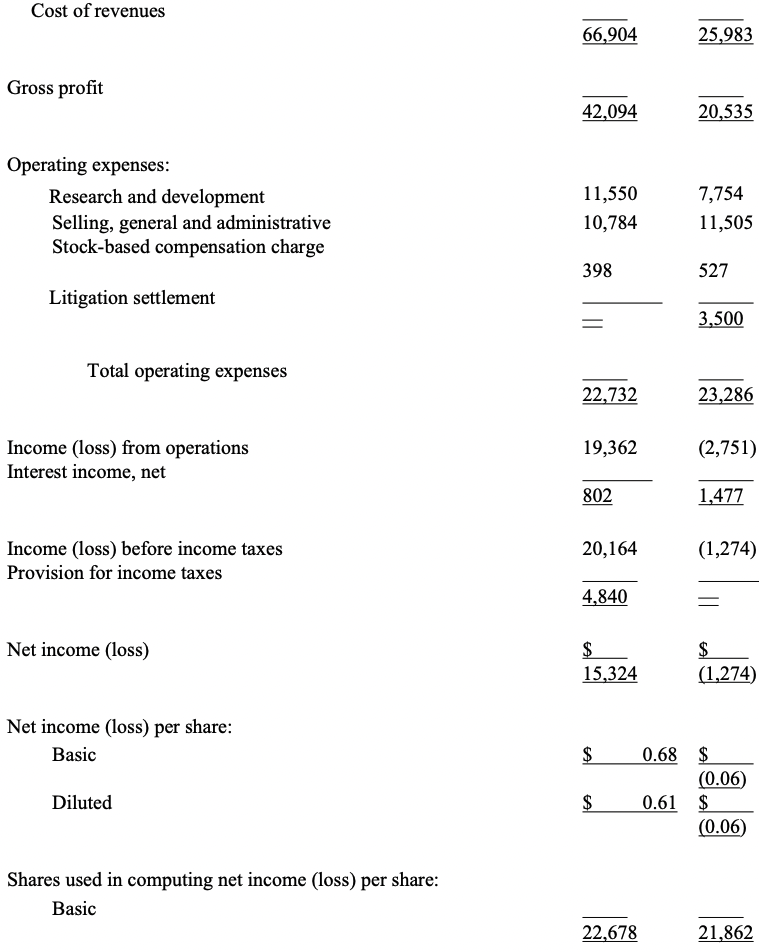

For its fiscal year 2003, OmniVision reported net income of $15.3 million, or $0.61 per diluted share, on revenues of $109.0 million, compared to a net loss of $1.3 million, or $0.06 per basic share, on revenues of $46.5 million in fiscal 2002. Fiscal 2002 results reflected a second-quarter charge of $3.5 million related to a litigation settlement.

For the three months ended April 30, 2003, gross profit was $15.4 million, or 38.4% of revenues, and included approximately $1.1 million from the sale of previously written off inventory; without the sale of previously written-off inventory, gross margin would have been 36.8%, and net income would have been approximately $5.3 million, or $0.21 per diluted share. In the comparable period a year ago, gross profit was $6.6 million, or 50.2% of revenues, and included approximately $1.7 million from the sale of previously written-off inventory; without the sale of previously written-off inventory, fourth-quarter 2002 gross margin would have been 42.7%, and the net loss would have been approximately $0.1 million, or $0.01 per basic share.

Because profits in fiscal year ended April 30, 2003 exceeded expectations, the tax rate for the three months ended April 30, 2003 increased to 33% from 19% in the prior quarter, to produce a blended tax rate of 24% for the four quarters of fiscal year ended April 30, 2003.

For the fiscal year ended April 30, 2003, gross profit was $42.1 million, or 38.6% of revenues, and included approximately $3.2 million from the sale of previously writtenoff inventory; without the sale of previously written-off inventory, gross margin for the year would have been 36.8%, and net income would have been $12.9 million, or $0.51 per diluted share.

Direct sales to original equipment manufacturers and value-added resellers accounted for approximately 61% of revenues, with the balance of approximately 39% coming from sales through the Company’s distributors. Research and development expenses were $3.3 million, or 8.3% of revenues, compared to $3.1 million, or 10.3% of revenues, in the prior quarter. Selling, marketing, general and administrative expenses were $3.1 million, or 7.8% of revenues, compared to $2.9 million, or 9.4% of revenues, in the prior quarter.

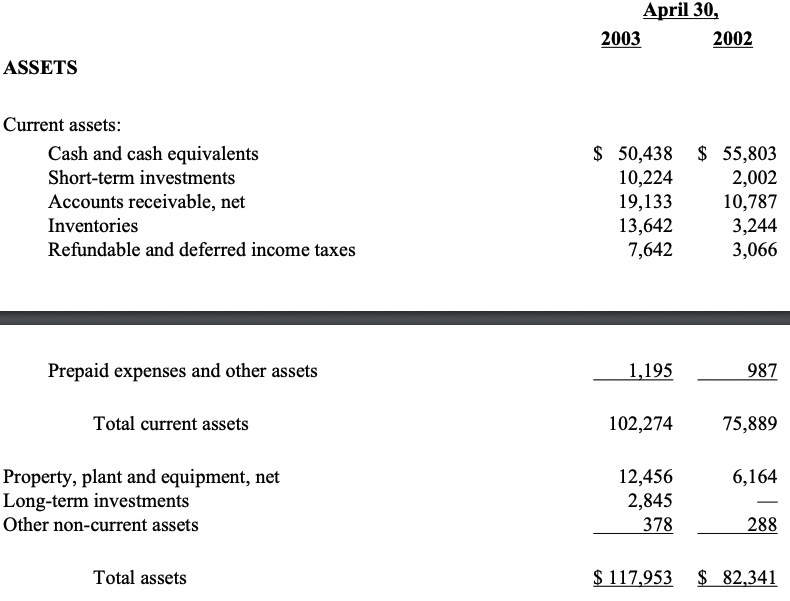

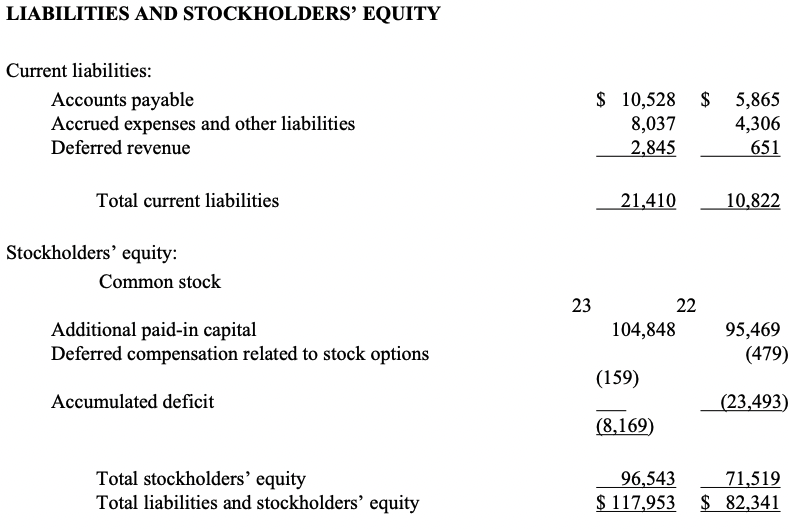

As of April 30, 2003, the Company had $60.7 million in cash and short-term investments, $80.9 million in working capital, no debt, and stockholders’ equity of $96.5 million.

For the quarter ending July 31, 2003, the Company currently expects to report earnings in a range of $0.18 to $0.19 per diluted share, on revenues of $41 to $43 million; these expectations do not presume the sale of any previously written-off inventory.

Safe Harbor

Certain statements in this press release, including statements relating to the Company’s expectations regarding revenues and earnings for the quarter ending July 31, 2003, are forward-looking statements that are subject to risks and uncertainties. These risks and uncertainties, which could cause the forward looking statements and OmniVision’s results to differ materially, include, without limitation: the degree to which intense competition might affect the Company’s ability to compete successfully in its current markets and in emerging markets; the failure to obtain design wins from camera and cell phone manufacturers, which could inhibit the Company’s ability to diversify its customer base; problems with wafer manufacturing yields, which could result in higher operating costs and adversely affect the Company’s revenues and earnings; the Company’s dependence upon a few key customers, which could adversely affect its revenues and earnings; a decline in the average selling price of the Company’s products, which could result in a decline in its gross margins; the failure of demand for the Company’s products in current markets and emerging markets to meet the Company’s expectations, which could result in lower revenues and earnings; and the other risks detailed from time to time in OmniVision’s Securities and Exchange Commission filings and reports, including, but not limited to, OmniVision’s quarterly reports filed on Form 10-Q. OmniVision disclaims any obligation to update information contained in any forward-looking statement.

(Financial tables follow)

OmniVision Reports Fourth-Quarter and Fiscal-Year 2003 Results

June 11, 2003

OMNIVISION TECHNOLOGIES, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

OMNIVISION TECHNOLOGIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

OMNIVISION TECHNOLOGIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)