— SEC Inquiry Terminated —

— Board Sets $100 Million Share Repurchase Program —

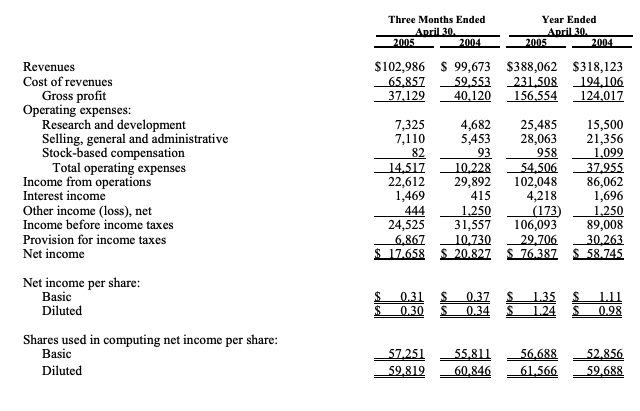

SUNNYVALE, Calif. — June 23, 2005 — OMNIVISION Technologies, Inc. (Nasdaq: OVTI), one of the world’s leading suppliers of CMOS image sensors, today reported that in the three months ended April 30, 2005, it earned $17.7 million, or $0.30 per diluted share, on revenues of $103.0 million. In the prior-year fourth quarter, the Company earned $20.8 million, or $0.34 per diluted share, on revenues of $99.7 million.

For the fiscal year ended April 30, 2005, OMNIVISION earned $76.4 million, or $1.24 per diluted share, on revenues of $388.1 million, compared to $58.7 million, or $0.98 per diluted share, on revenues of $318.1 million in fiscal 2004.

Gross profit for the fourth quarter of fiscal 2005 was $37.1 million, or 36.0 percent of revenues, compared to $41.5 million, or 40.7 percent of revenues, for the third quarter of fiscal 2005, and $40.1 million, or 40.3 percent of revenues, for the fourth quarter of fiscal 2004. The reduction in margin was caused principally by a temporary back-end yield issue with one of the Company’s new megapixel sensors.

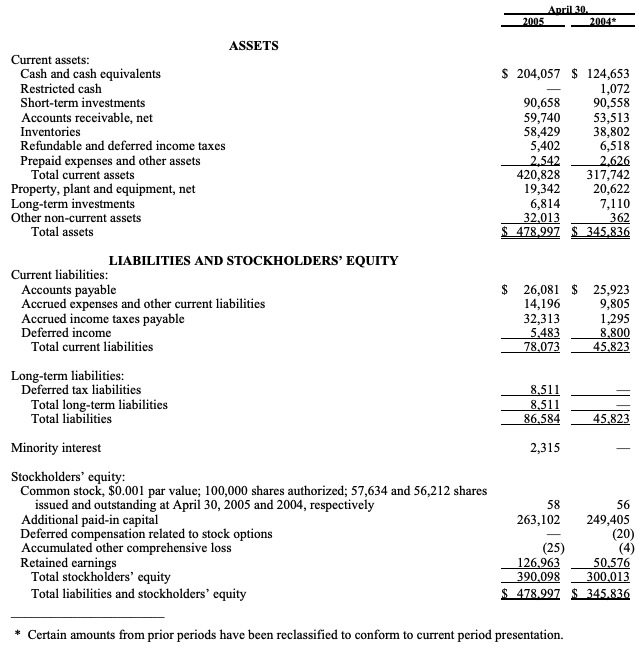

Inventories at year-end totaled $58.4 million. This includes $3.2 million of inventory held by the Company’s joint venture with Powerchip Semiconductor Corporation, Silicon Optronics Inc., which, as expected, has been consolidated for the first time as of April 30, 2005.

“The company made significant progress in fiscal 2005, and we are optimistic about our future,” said Shaw Hong, OMNIVISION’s president and chief executive officer. “We are pleased to have successfully completed the transition of our product line to the new OmniPixel® technology platform and to have completed the acquisition of CDM Optics. We are also pleased to have been informed by the SEC staff that their informal inquiry has been terminated without any recommendation for any enforcement action.

“We currently expect that revenues for the first quarter of fiscal 2006, which ends on July 31, will be in the range of $90 million to $100 million. However, design wins in recent months give us confidence that we will see a resumption of top-line growth beginning in the second quarter of the new fiscal year.

“The strength of our business is reflected in the fact that we ended the year with cash and short term investments totaling almost $300 million. Our confidence is underscored by the Board’s decision authorizing the repurchase of up to an aggregate of $100 million of our common stock.” For the first quarter of fiscal 2006, ending July 31, 2005, the Company currently expects that diluted earnings per share will be in the range of $0.22 to $0.27.

Teleconference

At 1:30 p.m. PDT (4:30 p.m. EDT) today, June 23, 2005, the Company will hold a teleconference to discuss the financial results. To participate in the teleconference, please call (toll free) 877‑869‑7690 approximately 10 minutes prior to the start time. For international callers, the dial-in number is 706‑758‑0239. You may also listen live via the Internet at the Company’s web site, www.ovt.com, or at www.earnings.com.

These web sites will host an archive of the teleconference. Additionally, a playback of the call will be available for 48 hours beginning at 4:30 p.m. PDT on June 23. You may access the playback by calling 800‑642‑1687, or for international callers 706‑645‑9291, and providing Conference ID number 7005250.

Safe-Harbor Statement

Certain statements in this press release, including statements relating to the Company’s expectations regarding revenue and earnings per share for the quarter ending July 31, 2005, the anticipated resumption of revenue growth in the quarter ending October 31, 2005, the temporary nature of the back-end yield problem with one of the Company’s new image sensor products are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on management’s current expectations, and as a result of certain risks and uncertainties actual results may differ materially from those projected. These risks and uncertainties include, without limitation, the following: the degree to which intense competition might affect the Company’s ability to compete successfully in current and emerging markets for image sensor products; risks associated with the Company’s ability to obtain design wins from camera, mobile phone and other image sensor device manufacturers, which could inhibit the Company’s ability to sustain and grow its business; risks associated with wafer manufacturing yields and other manufacturing processes, which could materially and adversely affect the Company’s revenue and earnings and its ability to satisfy customer demand; risks associated with the development of current and emerging markets for CMOS image sensor products, generally, and the Company’s products, specifically, which could result in lower revenue and earnings and adversely affect the Company’s business and prospects; risks associated with the Company’s ability to accurately forecast customer demand for its products, which could impair the Company’s ability to meet customer demand for its image sensor products and could also result in excess inventory; risks associated with the development, production, introduction and marketing of new products and technology, including the 3‑megapixel CameraChip™ product and the Company’s new OmniPixel® technology, which would adversely affect the Company’s ability to compete successfully in the CMOS image sensor market; the Company’s dependence upon a few key customers, the loss of one or more of which could materially and adversely affect the Company’s business and results of operations; risks associated with the Company’s ability to successfully implement its tax-planning strategies; uncertainties associated with the Company’s decision to restate certain of its fiscal 2004 quarterly results of operations; the Company’s ability to strengthen its internal controls over financial reporting and maintain an adequate level of financial processes and controls; a decline in the average selling price of the Company’s products, which could result in a decline in the Company’s revenue and gross margins; and the other risks detailed from time to time in the Company’s Securities and Exchange Commission filings and reports, including, but not limited to, the Company’s most recent annual report filed on Form 10‑K, as amended, and in the Company’s most recent quarterly report filed on Form 10‑Q. The Company expressly disclaims any obligation to update information contained in any forward-looking statement.

(financial tables follow)

OMNIVISION TECHNOLOGIES, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

(unaudited)

OMNIVISION TECHNOLOGIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(in thousands, except per share amounts)

(unaudited)